We’ve seen some definite shifts in demand and consequently value for several of our most popular hardwood species over the last couple of months. Tariff talks and trade war speculation has definitely stirred up the market, making many mills and secondary manufacturers quite nervous about their position going forward – at least in the short term.

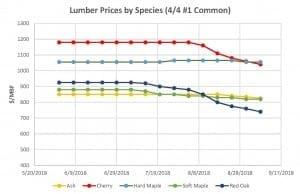

The (hopefully) temporary drop in Chinese purchasing of logs and lumber has certainly had a direct and quick impact on the hardwood lumber markets, with the heaviest hits coming to the two species that had seen the most significant increases over the past year. Black cherry, which started the year off at a price of $1,030/MBF 4/4 #1 Common, rose to a high of $1,180/MBF at the end of May and remained unchanged until the beginning of August, when it started its precipitous drop off to a current $1,040 – just about back to where it started in January. Red oak started off at $870/MBF for 4/4 #1 Common, rose to a high of $925/MBF back in April, and has since fallen to $740, $130 lower than where it began in January. Soft maple has seen nothing but a steady drop since January, starting off at $920/MBF 4/4 #1 Common and currently at $820/MBF. Ash, basswood, hickory and poplar have all had better trending success, with all four species currently at a price higher than they were at the beginning of the year.

Perhaps the silver lining in this news is that domestic, European and Asian demand (other than China) has increased and those buyers are taking advantage of the current downturn in export prices we are seeing. It will certainly be interesting to track the status of the continuing trade negotiations and see how they might affect our hardwood products. We will continue with on-going updates on this until it is hopefully all over in the not-too-distant future.