Global equity and commodity markets are currently seeing some significant fluctuations lately. As was mentioned in one of our last blog posts titled “Stock Market Make You Worried? Take a Walk in Your Woods,” it’s become more difficult to predict why these markets move the way they do.

“If you want anything good and competitively priced, you first look to the U.S.”

Certainly, there are some very visible events that influence investing trends, but the predictability of the market has become much more of an art than science over the years. Recent news that the Administration is talking about placing tariffs on steel and aluminum imports created another mild panic, as stocks again lost ground after mostly recovering from the “correction” that occurred several weeks back. Fears of a global trade war beginning have some advisors suggesting caution going forward, the European Union and other countries (including China) may retaliate and create additional uncertainties that make specific equity sectors very unattractive – at least in the short term.

Analysts are also reportedly concerned about an uptick in inflation – something that has been very well in control for quite some time. The fear that global trade battles will accelerate inflation within the US economy is also causing cautionary advice from professional account managers. It has been interesting to note that this talk of US tariffs on steel and aluminum has caused domestic steel manufacturing company stocks to increase, yet those companies that rely heavily on these metals for manufacturing – particularly the automobile and commercial airplane manufacturers – have seen their stocks drop somewhat sharply in a short amount of time.

Most economies are now no longer local or regional – they are global in nature. With transportation and technology advances over the years, competition has developed across the globe. And although sometimes seen as unfair due primarily to foreign wage discrepancies and government subsidies, the old axiom that “if you want anything good and competitively priced, you first look to the US,” is no longer true for everything – except for certain wood products; especially high-quality, high-value hardwoods.

Because of soils, climate, and sound management practices over many years, the US is the home of some of the world’s very best hardwood tree species that are sought after globally for high-end purposes. Beautifully grained and colored woods like black cherry, red and white oaks, sugar and red maples, white ash, hickory and walnut are still among the most preferred species for kitchen cabinets, tables, dressers, flooring, paneling, moldings and a host of other furnishings. Some of the very best of these species grow in New York, Pennsylvania and West Virginia and are prized by both domestic and international consumers, creating a two-tiered marketplace which has provided a healthy diversity for demand over the years.

With international trade currently the focus of significant attention, we thought it would be interesting to provide an insight into the degree of the demand the international markets have for our hardwood species. To do this, we consulted with an industry-standard publication called the Hardwood Weekly Review, published in North Carolina (www.hardwoodreview.com; George Barrett, Editor). In cooperation with the U S International Trade Commission, they provided some very interesting and eye-opening information about the value our exports of hardwood logs have, and the extent, by country, that they are in demand.

The following chart shows the total volumes of logs (all species, combined) exported to various countries for the periods of January through November 2016 and January through November 2017. This data shows an overall increase in exported volumes by 3.5% from 2016 to 2017, with the largest increase in terms of percentage coming from Italy (22.6%) but the largest increase in terms of sheer volume coming from China (152,359 cubic meters); this volume increase from China is greater than any other country in total. The total volume of 1,964,711 cubic meters exported between January through November of 2017 is equivalent of approximately 550,119,000 board feet of material as measured in the International ¼” Log Rule.

Equating these export volumes to actual trade dollars shows a more significant upward trend occurring between the last two years. From January through November of 2017, the US exported approximately $776,562,184 of logs to other countries, up approximately 17% from the same period in 2016. As shown below, China is once again the major importer of our logs, purchasing about 67% of our total hardwood log exports in terms of dollars in 2017.

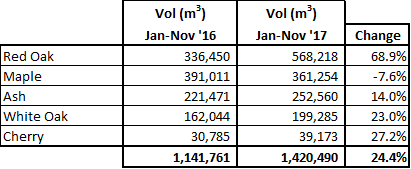

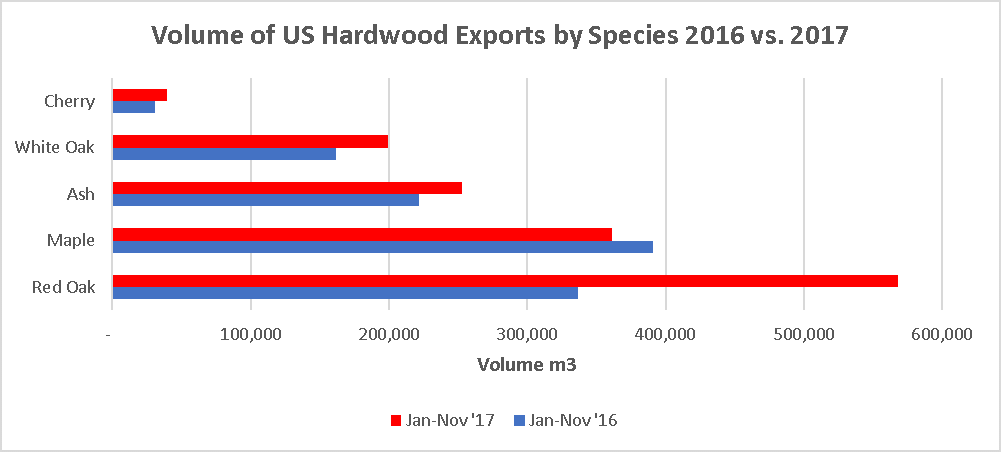

Boiling this down to the 5 major hardwood species (in terms of volume) being exported, there was a significant increase (almost 25%) between 2016 and 2017, with red oak being in highest demand, followed by the maples, ash, white oak, and then cherry. Red oak had a very significant upward demand shift (+68.9%), and cherry also improved significantly with a 27.2% increase.

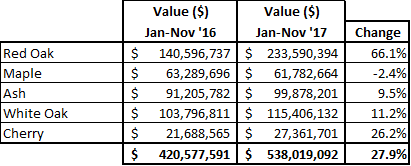

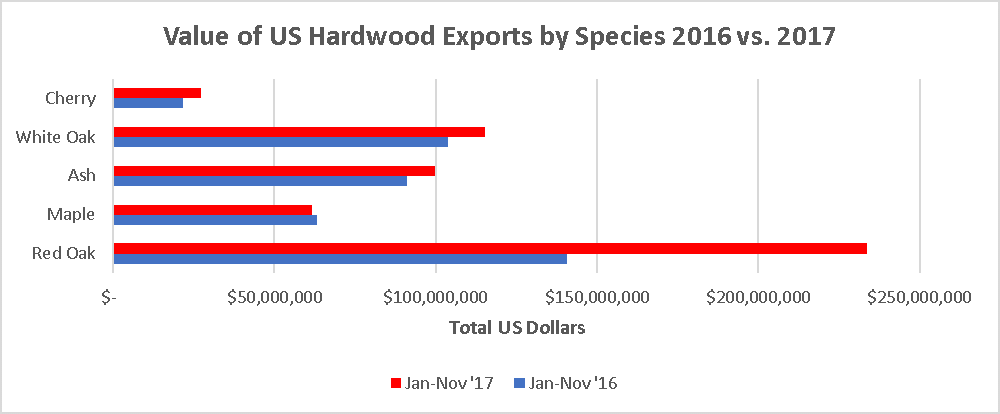

In terms of value, the table and chart below show red oak not only the highest among these species in terms of total export dollars, but also in terms of change in export value as well (66.1% increase from 2016 to 2017). Overall, for these 5 species combined, the US trade export value for these hardwood species increased from approximately $420,577,000 (Jan-Nov 2016) to approximately $538,019,000 (Jan-Nov 2017), or an increase of about 27.9%.

Besides log exports, other countries take in exports of our lumber products as well. Though values associated with these exports weren’t available at the time of this writing, the follow table and chart shows that Asia (primarily China, followed by Vietnam) had the highest demand for our hardwood lumber, with shipments of approximately 1.3 billion board feet to this region in 2017, setting an all-time export record. Asia accounted for approximately 69% of the total exports of lumber from the US last year. Canada was second in terms of total export volume, increasing its overall volume demand by 4% from 2016 (from approximately 221 million board feet to 230 million board feet).

Third in total export volume was Europe, taking in a reported 155 million board feet – up 3% from 2016. Finally, Latin America had a very strong increase in hardwood demand from the US, increasing its 2016 demand by 12%, with 152 million board feet delivered to that region in 2017. As with Asia, Latin America’s demand was also an all-time record.

By species, here’s a chart that illustrates the significance of this demand:

There is no question that our hardwood resource is in demand around the world for a variety of reasons, and that it supplies significant trade dollars to the US. While it may be getting easier over time for other countries to reproduce goods and services that were once the cornerstone of the US economy, it would be very difficult to reproduce the specific site qualities and characteristics needed to produce a supply of these valuable hardwoods that literally grow in our backyards here in parts of the US.

Since 1954, FORECON has been helping landowners manage and market their valuable hardwood resource. Today’s international and domestic demand has significantly improved the values that woodlot and forest landowners are seeing when selling their timber – our bid sale process and results prove out the regional and local impact that demand from these different markets are providing, all to the benefit of our clients. Should you have any timber you would like to sell, or if you are simply curious about our sale process, please don’t hesitate to contact our foresters at any of our offices. They would be glad to speak with you.