At the risk of sounding like a broken record (there’s an analogy from the past….!), lumber, log and stumpage prices continue to remain strong into the mid-spring months. In general, mills continue to report increased production, taking full advantage of generally better weather conditions and strong demand. As reported last time, we are witnessing very active timber sale bid participation and excellent prices being paid.

According to the Hardwood Weekly Review, “strong demand continued for Ash, Cherry, Walnut and White Oak logs and lumber, and Ash’s increasing scarcity pushed KD lumber prices higher in Appalachia and the North” (May 18, 2018, Vol. 33, Issue 35, page 12). Log yard inventories have been low and green lumber supply has been behind more so than normal this time of year. Flooring, millwork, rail ties and crane mats continue to be in high demand. Export and domestic demand remain steady and strong.

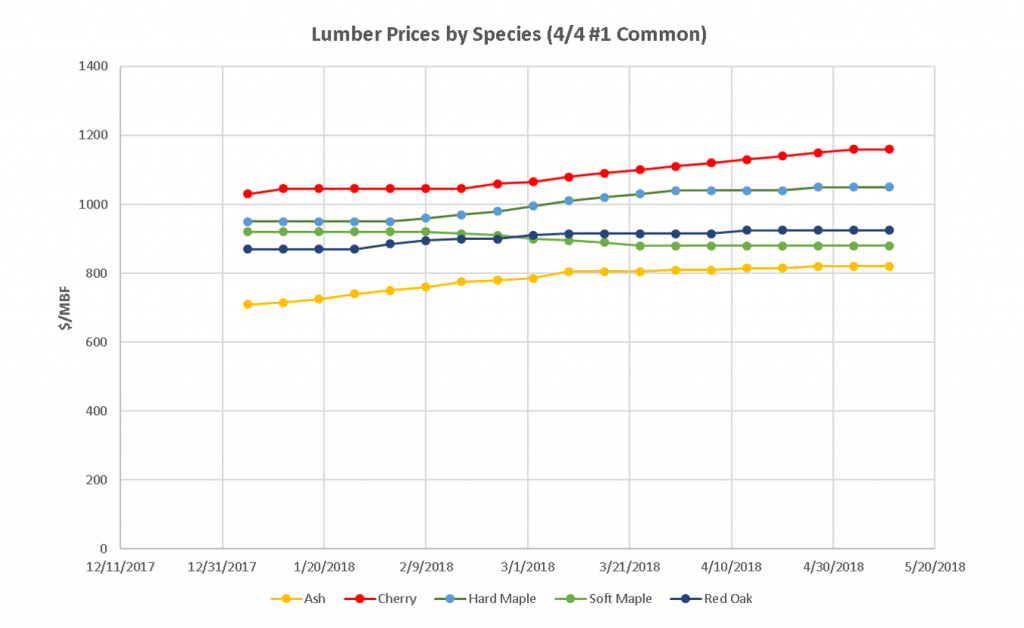

Ash lumber prices have steadied over the last three weeks, now at one of its highest price levels ever. Despite the supply of ash stumpage being plentiful due to the continued acceleration of harvests ahead of the devastating effects of the emerald ash borer, demand remains as strong as ever, both internationally and domestically. Cherry continues to move upward, increasing another $20/Mbf since the last blog post. Chinese demand remains very high, with expectations that cherry prices for lumber, logs and stumpage will continue to increase – slowly but steadily – for the foreseeable future. Hard maple demand is steady, with slight increases seen since the last report. It’s possible that hard maple prices will level off going into the summer months as is usually the case, but what used to be predictable seasonal fluctuations might no longer be the norm. Soft maple markets have remained steady, with higher quality stock tipping upward in price. Red oak demand remains steady, with the slight downturn in international (primarily Asian) demand being offset by domestic interest.

Appalachian U.S. Lumber Prices May 2018

(click to enlarge)